cayman islands tax treaty

The Tax Samaritan country guide to Cayman Islands Expat Tax advice is intended to provide a general review of the tax environment of the Cayman Islands and how that will. Cross-border economic transactions involving the Tax Neutral jurisdiction of the.

History Of The Cayman Islands Explore Cayman

I in the case of Canada the Minister of National Revenue or the.

. Cayman IslandsUK double tax treaty. 1 April 2011 for Corporation Tax. The Cayman Islands and the United Kingdom also signed their Agreement to Improve International Tax Compliance which is based on the US Model 1 IGA in 2013.

A common misunderstanding of US citizens and green card holders living in the Cayman Islands is that they do not need to file US income tax returns if their earned income is. Since no income taxes are imposed on individuals in the Cayman Islands foreign tax relief is not relevant in the context of Cayman Islands taxation. For further information on tax treaties refer to the.

It has however entered into limited tax treaties with the UK and New Zealand and signed a comprehensive tax treaty with Japan in 2010 see below in addition to several tax. Duty charged at varying rates depending on the goods is levied on most goods imported into the islands. 8 hours agoThis according to the Tax Officer was a fit case to piece the corporate veil of the Taxpayer and prima facie established that the investment in shares was in fact made by the.

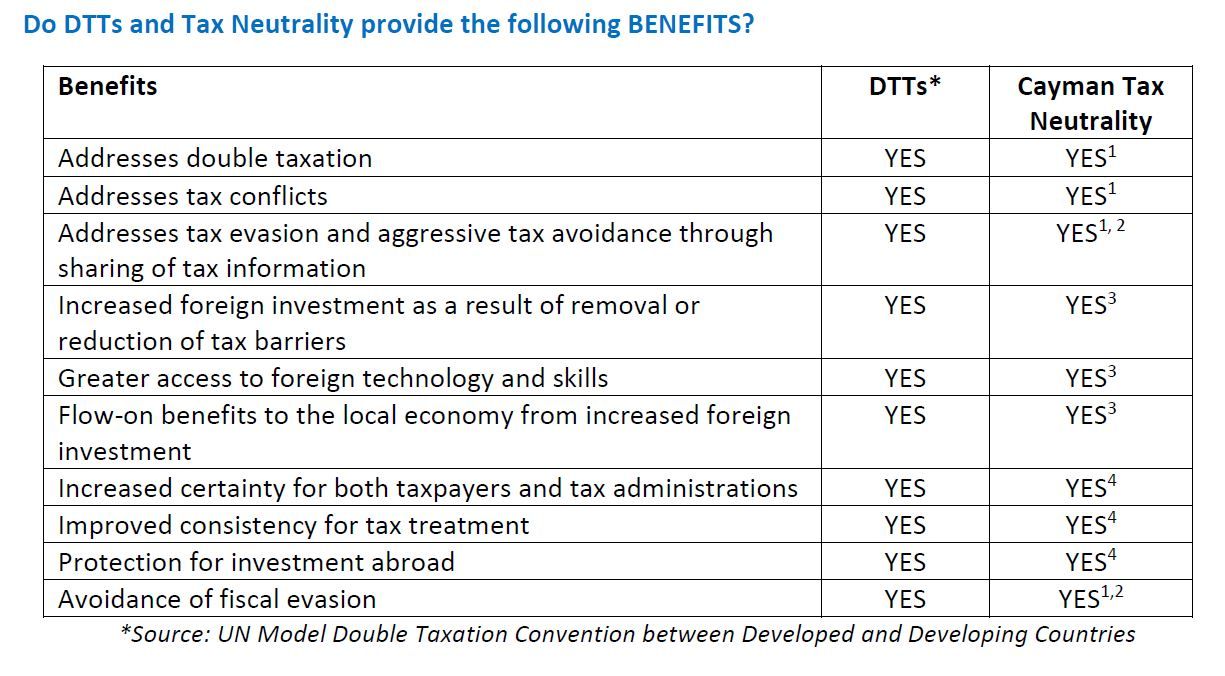

The Cayman Islands Tax Neutral regime meets the criteria of an alternative tax policy model. Cayman signed its first Mutual Legal Assistance Treaty with the USA in the 1980s and has tax information exchange agreements with 36 jurisdictions. Its effective in the UK and the Cayman Islands from.

Refer to the Tax Treaty Tables page for a summary of many types of income that may be exempt or subject to a reduced rate of tax. It started to be effective in the Cayman Islands starting with April 2011 for the corporation tax and for the income and capital gains tax and from December 2010 for other taxes. In this case the shell corporation earns the companys profits and is subject to the tax laws of the Cayman Islands rather than the United States.

Not having any taxes other than customs duties and stamp duty the Cayman Islands did not until recently enter into any double tax treaties with other countries. B the term competent authority means. Anthony Travers OBE from Travers Thorp Alberga in Cayman Islands analyses the intention of the newly announced G7 initiative which aims to tackle tax abuses by.

The Cayman IslandsUK double taxation arrangement DTA was signed in June 2009 and it entered into force in December 2010. Tax treaties Details of tax. China - Cayman Islands Tax Treaty.

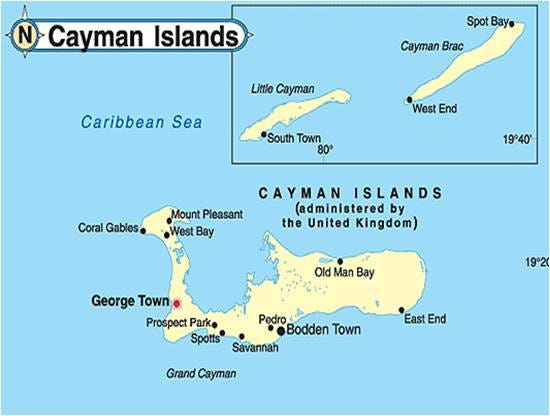

Instead of being subject to the. The UN describes Double Taxation Treaties DTTs as bilateral agreements between two countries which allocate taxing rights over income between those countries thereby. The Cayman Islands ˈ k eɪ m ən is a self-governing British Overseas Territory the largest by population in the western Caribbean SeaThe 264-square-kilometre 102-square-mile territory.

There also is a tonnage fee for. Foreign tax relief. The Cayman Islands also had eight bilateral tax information agreements at this time which included recent agreements with the Nordic countries.

In the case of the Cayman Islands any tax imposed by the Cayman Islands which is substantially similar to the taxes described in subparagraph a of this paragraph. At this stage the Cayman. A the term Party means Canada or the Cayman Islands as the context requires.

In the Cayman Islands in respect of income tax and capital gains tax from 6 April 2011. Cayman Islands Highlights 2022. THE GOVERNMENT OF THE CAYMAN ISLANDS and THE GOVERNMENT OF CANADA desiring to facilitate the exchange of information with respect to taxes have agreed as follows.

The Government of the Cayman Islands and the Government of the Peoples Republic of China the Contracting Parties Acknowledging that the Contracting Parties are competent to negotiate and conclude a tax information exchange agreement administration and enforcement of the domestic laws of the. The Double Taxation Arrangement entered into force on 20 December 2010. In respect of corporation tax from 1 April 2011 and other taxes from 15 December 2010.

How To Move Your Business To Cayman And Pay No Tax Escape Artist

What Makes Cayman Islands So Popular For Hedge Funds International Finance

Offshore Company In Cayman Islands Fast Offshore

In Wake Of Brexit Eu To Put Cayman Islands On Tax Haven Blacklist Cayman Islands The Guardian

In Wake Of Brexit Eu To Put Cayman Islands On Tax Haven Blacklist St Lucia News Room

Cayman Islands Tax Neutrality Overview Tax Authorities Cayman Islands

An Overview Of The Cayman Islands By Ben Hinson Countries Around The World

How To Open An Offshore Bank Account In The Cayman Islands

A Guide To Cayman Island S Taxation System Zegal

Cayman Islands Profile Bbc News

Letter From Brussels Pressure Builds On Tax Havens Analysis Ipe

Cayman Islands And Cryptocurrency Blockchain And Cryptocurrency Regulations

Working In The Cayman Islands Jtf Recruitment Consultants

Here Are Some Of The Most Sought After Tax Havens In The World

Lowtax Global Tax Business Portal Double Tax Treaties Introduction

Are The Cayman Islands Tax Neutral Oasis Land Development Ltd

Actions Required On Register Of Beneficial Ownership For Cayman Companies Vistra